July 29, 2025

Dear Valued Shareholder,

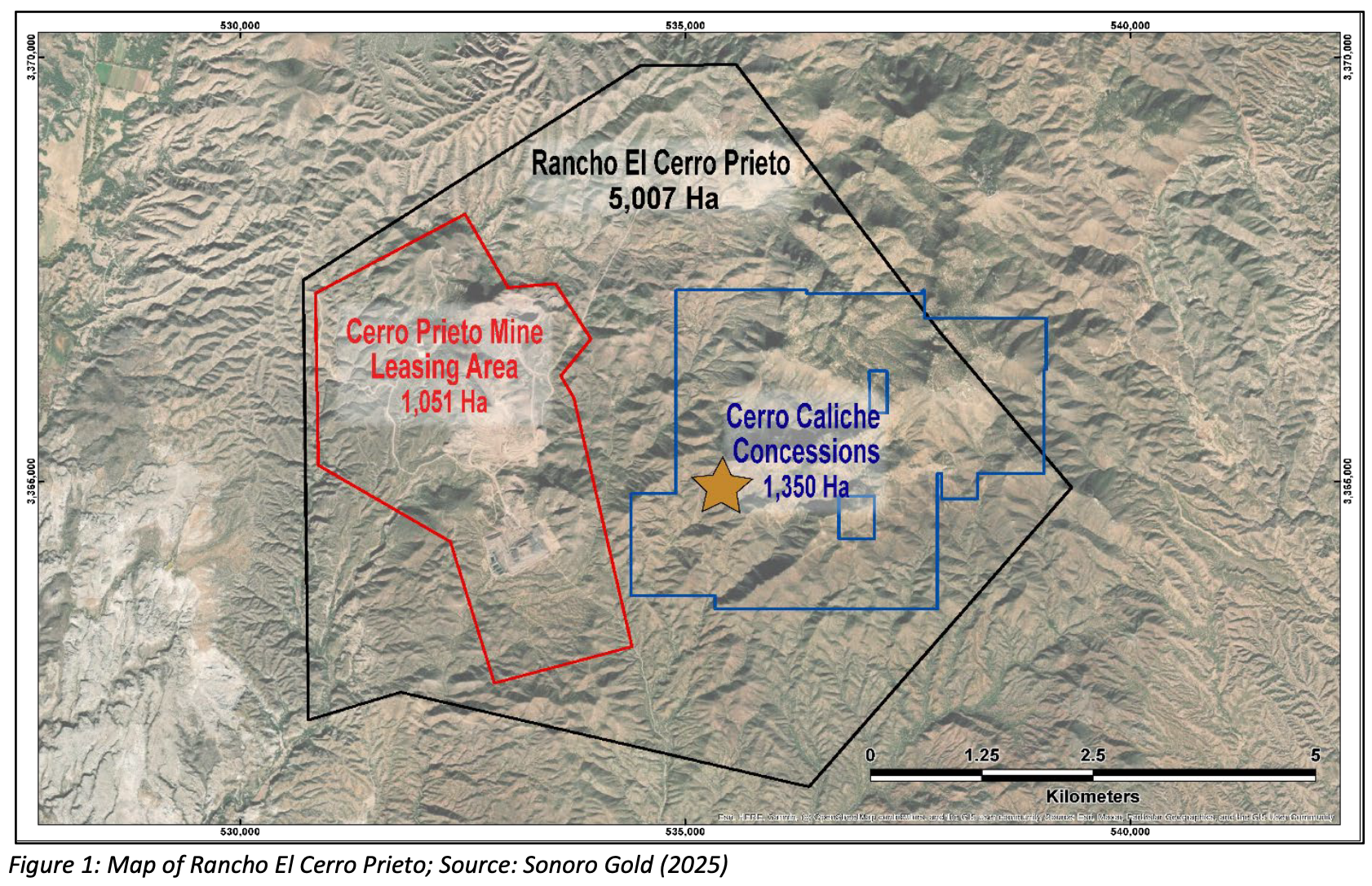

On July 4, 2025, Sonoro Gold (Sonoro) announced that it had secured the surface rights for its Cerro Caliche Gold Project in Sonora, Mexico. The lease agreement grants Sonoro’s wholly owned Mexican subsidiary, Minera Mar De Plata S.A. DE C.V. (MMP), the exclusive right to explore, develop and extract mineral deposits and construct the related mining infrastructure.

Securing the surface rights for the proposed Cerro Caliche mining operation is a significant and timely milestone in the project’s development. As disclosed in the 2023 Preliminary Economic Assessment (PEA), mineral rights in Mexico are separate from surface rights and concession holders are required to secure land access directly from landowners. MMP now controls 100% of the surface and mineral rights for the Cerro Caliche project area, thereby substantially de-risking the on-going development of the gold project.

Under the agreement, Sonoro has exclusive surface rights to the Rancho El Cerro Prieto property covering 3,908 hectares, including the 15 contiguous Cerro Caliche mining concessions covering a total area of 1,350 hectares. On September 1, 2028, the surface rights will expand to 5,007 hectares.

The lease has a term of up to 25 years, comprising an initial term of 12.5 years, with Sonoro having an option to renew the lease for an additional 12.5 years.

On July 9, 2025, Sonoro provided a status update on Cerro Caliche’s Manifestacion de Impacto Ambiental (MIA), or an Environmental Impact Statement (EIA). The MIA is the mandatory federal permit for the construction and operation of mines in Mexico and governs the overall environmental and socio-economic impacts of extractive industry. In recent years, we have seen significant reform of Mexico’s mining laws and regulations with emphasis on environmental protection and community well-being.

Permitting delays have pushed back multiple projects in Mexico due to increased scrutiny over water use, environmental impact and community engagement. Sonoro has made on-going revisions to its MIA submission with the objective of optimizing the project’s footprint and ensuring the proposed mine meets the highest social and environmental standards.

While Sonoro has no control over the government’s permitting timeline, Management remains confident that the Cerro Caliche MIA will be approved.

Permitting is a complex process involving on-going stakeholder engagement and environmental review within a shifting geopolitical landscape. On June 23, 2025, Mexican President Claudia Sheinbaum announced that her administration will not advance the prior administration’s proposal to ban all open-pit mining. President Sheinbaum also announced that no new mining concessions will be granted under the current administration.

I would like to remind shareholders that Sonoro holds 100% title to the concessions for its Cerro Caliche project and is focused on advancing the project to early production. With just 30% of known mineralized areas drilled and assayed to date, Sonoro filed a PEA in August 2023 for a proposed nine-year open-pit, heap leach operation. Revenues from production will fund potential expansion of mineralization to potentially increase production and extend the mine life.

As stated in the project’s updated Mineral Resource Estimate filed in March 2023, there is upside exploration potential at Cerro Caliche, as well as additional opportunities along strike and parallel to the project’s current vein trends.

Sonoro also holds 100% title to the concessions for its San Marcial gold-silver project, also located in Sonora, Mexico. The project overlays the historic Soledad and San Marcial mine sites and was the subject of several drilling programs during the 1980s and 1990s. Sonoro acquired the San Marcial project in 2014 and undertook an extensive soil sampling program, revealing anomalous zones with multiple structural trends with gold and silver mineralization.

The Company plans to resume exploration in the near future with an initial large grid drill program at selected mineralized zones. Management believes the San Marcial project has the potential for large low-grade gold-silver mineralization.

However, the Company’s primary objective is to move its flagship Cerro Caliche project to early production to fund future expansion with minimal dilution. The reinvigoration of Mexico’s extractive industry, rising gold prices and the intrinsic and potential value of Cerro Caliche, I believe, is strengthening investor sentiment.

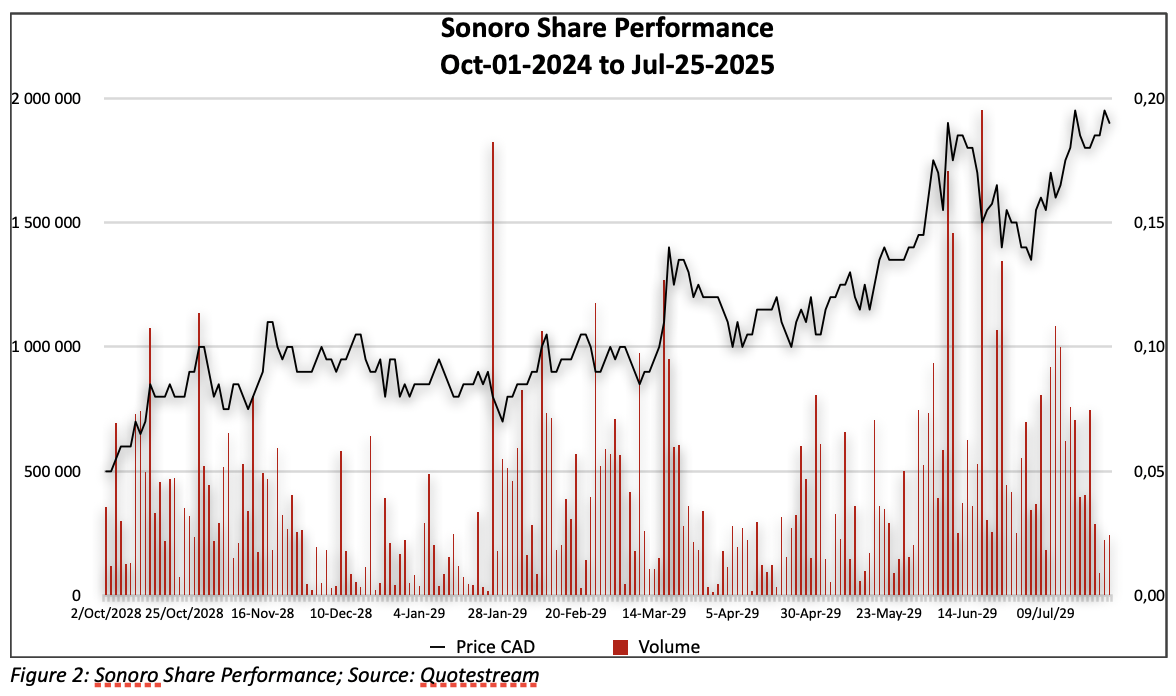

Over the past 10 months, Sonoro’s shares have experienced strong growth with excellent liquidity in the Canadian, US and German stock markets.

This year, shareholders and insiders exercised over 28 million warrants at an average cost of $0.11 per share thereby increasing insiders’ control to over 28%. Value Added Tax (VAT) refunds received to date total approximately CAD $250,000, with a further CAD $2.1m in VAT refunds expected by Q1 of 2026.

With the surface rights now secured, management is actively evaluating project financing opportunities for project development. To minimize shareholder dilution, the project financing will focus on maximizing the percentage of the project debt thereby minimizing the equity component. Alternative funding, including non-dilutive gold loans, is also being investigated by management.

Although an approved MIA is required for the construction of the proposed mining operation, securing pre-construction financing to fund operating costs, as well as specific activities, would further de-risk the project. These important components of the project’s development include detailed engineering, infill drilling and updated technical assessments. As noted above, while management cannot control when the MIA will be granted, by continuing to push the project forward with certain activities, we can further de-risk the project and potentially accelerate the timeline to production once the permit is granted.

I believe it is important to note that while permitting delays have impacted the development timeline for Cerro Caliche, the Company’s insiders have attempted to minimize shareholder dilution by funding high-cost expenditures that would typically be included in project financing, including concession and surface rights payments. Such funds have been advanced as unsecured shareholder loans without any rights of conversion into shares. All private placements have been non-brokered and minimal to provide cash flow without unnecessary dilution.

Sonoro believes in the intrinsic value of the Cerro Caliche project and the growth potential of the Company. Sonoro has all the essential components to build Sonoro into a successful gold producer:

- A proven and successful management team with extensive expertise in the discovery, delineation and development of mineral deposits.

- The Cero Caliche gold project is currently in the permitting phase for an initial 9-year open pit, heap leach mining operation with significant expansion potential.

- Insiders hold 28.4% of the Issued and Outstanding shares and the Company is fortunate to have a loyal shareholder base across Canada, USA, Germany and Switzerland.

- A strategic business plan to bring Cerro Caliche into production with minimum dilution, to finance ongoing expansion of the project’s oxide gold resource.

- Management has a strong history of successfully securing significant financing for natural resource ventures and to date, has successfully raising over CAD$27.47 million to date.

I invite you to view our updated Mission Statement and, as always, please contact me directly at john@sonorogold.com with any questions or comments on the Company or the Cerro Caliche project.

Kindest Regards,

John M. Darch, Chairman

Sonoro Gold Corp.

Forward-Looking Statement Cautions:

This Chairman’s massage may contain “forward-looking information” as defined in applicable Canadian securities legislation. All statements other than statements of historical fact, included in this release, including, without limitation, statements regarding the Cerro Caliche project, and future plans and objectives of the Company, constitute forward looking information that involve various risks and uncertainties, including statements regarding the amount of financing proposed to be raised, intended use of the financing proceeds, sufficiency of fund to complete certain project development steps, and outlook for the results of the contemplated drilling program. Although the Company believes that such statements are reasonable based on current circumstances, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are statements that are not historical facts; they are generally, but not always, identified by the words “expects”, “plans”, “anticipates”, “believes”, “intends”, “estimates”, “projects”, “aims”, “potential”, “goal”, “objective”, “prospective” and similar expressions, or that events or conditions “will”, “would”, “may”, “can”, “could” or “should” occur, or are those statements, which, by their nature, refer to future events. The Company cautions that forward-looking statements are based on the beliefs, estimates and opinions of the Company’s management on the date the statements are made and they involve a number of risks and uncertainties, including the possibility of unfavorable exploration and test results, the lack of sufficient future financing to carry out exploration and development plans and unanticipated changes in the legal, regulatory and permitting requirements for the Company’s exploration programs. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law or the policies of the TSX Venture Exchange. Readers are encouraged to review the Company’s complete public disclosure record on SEDAR at www.sedar.com.

This message does not constitute or form a part of any offer or solicitation to purchase or subscribe for securities in the United States. The securities referred to herein have not been and will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), or with any securities regulatory authority of any state or other jurisdiction in the United States, and may not be offered or sold, directly or indirectly, within the United States or to, or for the account or benefit of, U.S. persons, as such term is defined in Regulation S under the Securities Act (“Regulation S”), except pursuant to an exemption from or in a transaction not subject to the registration requirements of the Securities Act”

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this message.