SONORO ANNOUNCES POSITIVE UPDATED PEA RESULTS INCREASING PRE-TAX NPV TO USD $84.4 MILLION AND PRE-TAX IRR TO 74.9%

![]() VANCOUVER, Canada, May 9, 2022 – Sonoro Gold Corp. (TSXV: SGO | OTCQB: SMOFF | FRA: 23SP) (“Sonoro” or the “Company”) is pleased to announce the positive results of an updated independent Preliminary Economic Assessment (“PEA”) on the Company’s Cerro Caliche gold project located in Sonora State, Mexico. The updated PEA highlights several opportunities to potentially increase the project’s previously reported economic parameters, as well as potentially lower several identified risks. As the engineering and costing outlined in both the initial and updated studies are at the PEA level, potential variations in operation and capital costs may occur.

VANCOUVER, Canada, May 9, 2022 – Sonoro Gold Corp. (TSXV: SGO | OTCQB: SMOFF | FRA: 23SP) (“Sonoro” or the “Company”) is pleased to announce the positive results of an updated independent Preliminary Economic Assessment (“PEA”) on the Company’s Cerro Caliche gold project located in Sonora State, Mexico. The updated PEA highlights several opportunities to potentially increase the project’s previously reported economic parameters, as well as potentially lower several identified risks. As the engineering and costing outlined in both the initial and updated studies are at the PEA level, potential variations in operation and capital costs may occur.

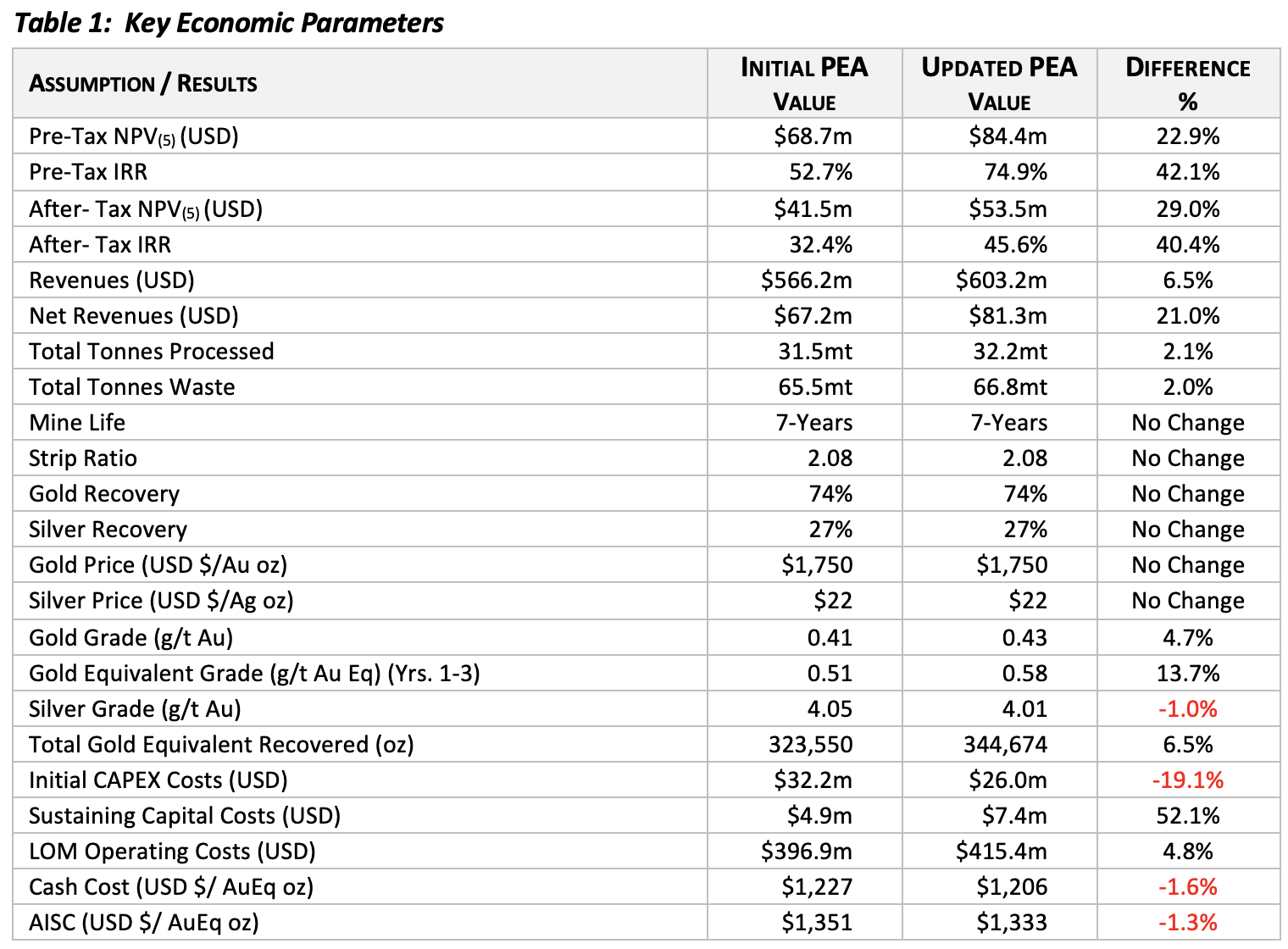

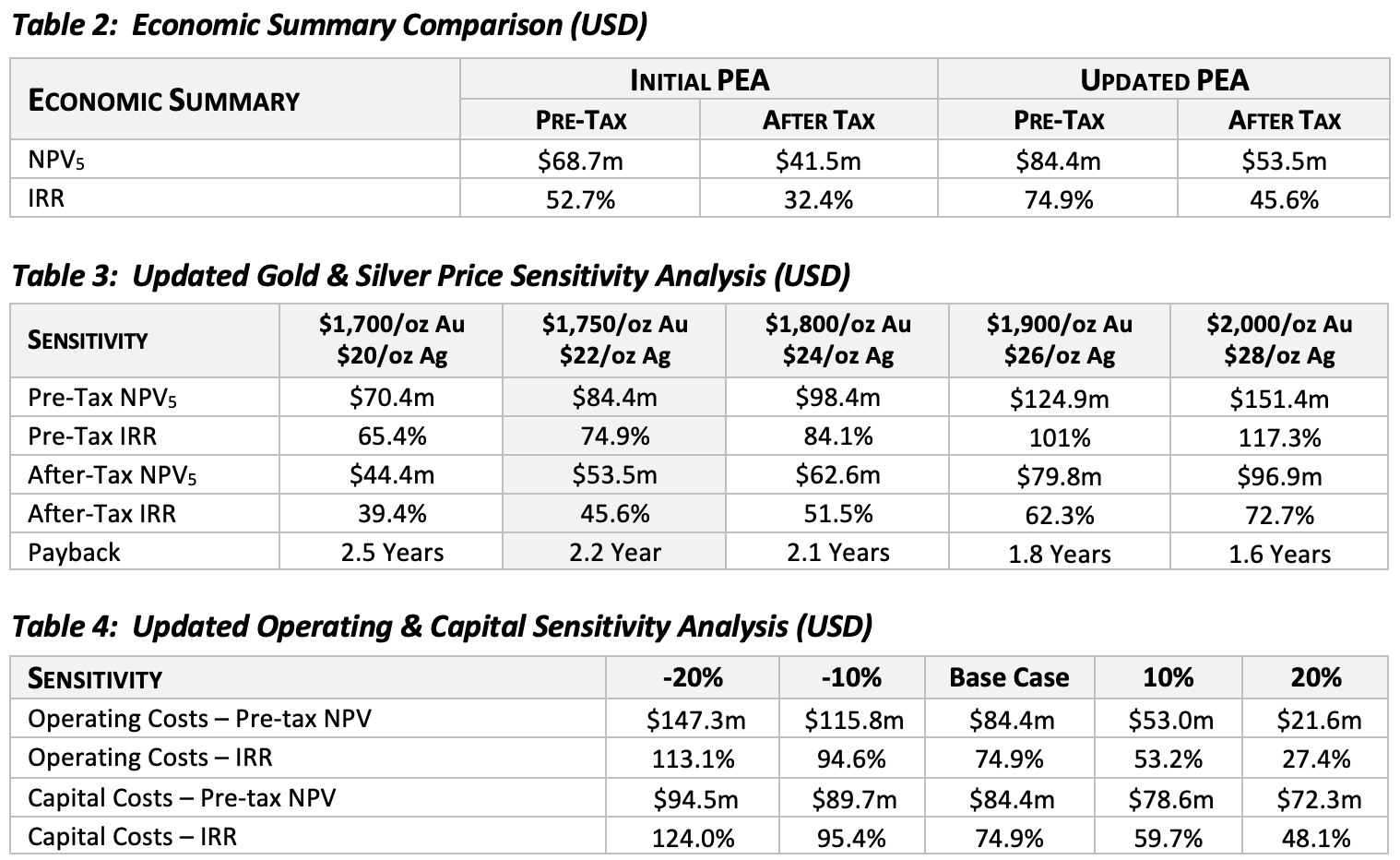

Based on the same mineral resource estimate contained in the Company’s initial PEA, dated October 29, 2021, the updated PEA contemplates an optimized mine plan for an open pit, heap leach mining operation with an initial two-year production rate of 8,000 metric tonnes per day (“mtpd”) and an increase to 15,000 mtpd for the remaining life of mine (“LOM”).

The updated PEA has been prepared in accordance with the requirements of National Instrument 43-101 (“NI 43-101”) by D.E.N.M. Engineering Ltd. of Burlington, Ontario (“D.E.N.M.”), with confirmation of the applicable resource estimates completed by Micon International Limited of Toronto, Ontario (“Micon”).

Updated PEA Highlights:

- Pre-Tax net present value discounted at 5% (“NPV5”) of USD $84.4 million

- Pre-Tax Internal Rate of Return (“IRR”) of 74.9%

- After-Tax NPV5 of USD $53.5 million with an IRR of 45.6%

- Gold recovery of 74% and silver recovery of 27%

- 7-year LOM with 344,500 ounces (“oz”) of gold equivalent (“AuEq”)

- LOM annual average production of 45,000 oz AuEq (Years 1-7)

- Years 1 to 3 annual production of 46,000 oz AuEq at 0.58 g/t AuEq

- Initial CAPEX costs of USD $26 million, including USD $3 million in contingency

- Sustaining capital costs of USD $7.4 million

- Cash(1) costs of USD $1,206/oz AuEq

- AISC(2) of USD $1,333/oz AuEq

- Payback period of 2.2 years

Note: All currencies are reported in U.S. dollars. Base case parameters assume $1,750/oz of gold and $22/oz of silver.

(1) Cash costs include mining, crushing, processing, assaying, and administration.

(2) All-in-Sustaining Costs include cash costs plus sustaining, refining and reclamation costs, as well as 2% royalties.

Ken MacLeod, President and CEO of Sonoro, stated, “We are very pleased with the improved economic parameters of the updated PEA. Using the same resource calculations of the original PEA, we have optimized the mine plan to contemplate commencing production at a lower rate utilizing higher-grade ore, eventually ramping up to potential capacity of 15,000 mtpd in year three. The result is a reduction in the estimated initial CAPEX of over 19% and an increase in after-tax NPV and IRR of 29% and 40.4%, respectively.”

John Darch, Chairman of Sonoro, added, “The updated PEA again highlights the intrinsic value of the Cerro Caliche project, and we continue to assess options to potentially further improve the project’s economic viability, such as leasing large capital cost equipment. The updated PEA does not include the nearly completed drilling campaign, which commenced in November 2021 after the initial PEA was published. We are excited to review the potential for resource growth from the new geological data. An increase in the size and grade of the resource may potentially further improve the project’s economics and extend the proposed life of mine.”

Mineral Resource Estimate

The updated PEA utilizes the same geological data as the initial PEA, filed in October 2021, and is based on the Company’s September 2018 to April 2021 drilling campaigns. As previously announced, the PEA estimates Measured and Indicated Mineral Resources of 349,000 ounces of gold at a 0.41 g/t Au grade and Inferred Mineral Resources of 71,000 ounces of gold at 0.40 g/t Au grade. The original report also notes a range of the potential mineralization that may conceptually exist outside of the resource pit shells believed to be from 19,250,000 to 34,370,000 tonnes containing 204,000 to 365,000 ounces of gold, as well as 1,683,000 to 3,005,000 ounces of silver.

Readers are cautioned that these potential mineralization ranges are conceptual in nature and that despite being based on a limited amount of exploration drilling and sampling outside the current resource pit shells, it is uncertain that further exploration will result in the mineralization targets being delineated as a mineral resource.

Drilling Data

Approximately 7,000 meters of additional drilling being completed at Cerro Caliche was not included in the current mineral resource estimate. Final assay results are still pending with the new geological data to be included in a further updated resource estimate scheduled to be released in the fall of 2022.

Since drilling resumed in November 2021, the Company has announced multiple high-grade intercepts and expansions of several known mineralized zones in the southwestern region of the property. The potential economic impact of these results on the proposed mining operation will also be assessed in the updated resource estimate.

PEA Summary

The optimized mine plan outlined in the updated PEA increased total tonnes processed from 31.5 million tonnes to 32.2 million tonnes and total waste from 65.5 million tonnes to 66.8 million tonnes. Optimization also increased the average gold grade from 0.41 g/t Au to 0.43 g/t Au for the LOM, as well as the average gold equivalent from 0.51 g/t AuEq to 0.58 g/t AuEq during the first three years of production.

Total recovered gold equivalent increased from 323,550 ounces to 344,674 ounces.

The updated PEA is preliminary in nature and includes inferred resources that are considered too speculative to have the economic considerations applied to them that would enable them to be categorized as mineral reserves and there is no certainty the estimates presented in the PEA will be realized.

The full PEA will be filed on SEDAR at www.sedar.com and Sonoro’s website www.sonorogold.com within 45 days of the issuance of this news release.

Capital Costs

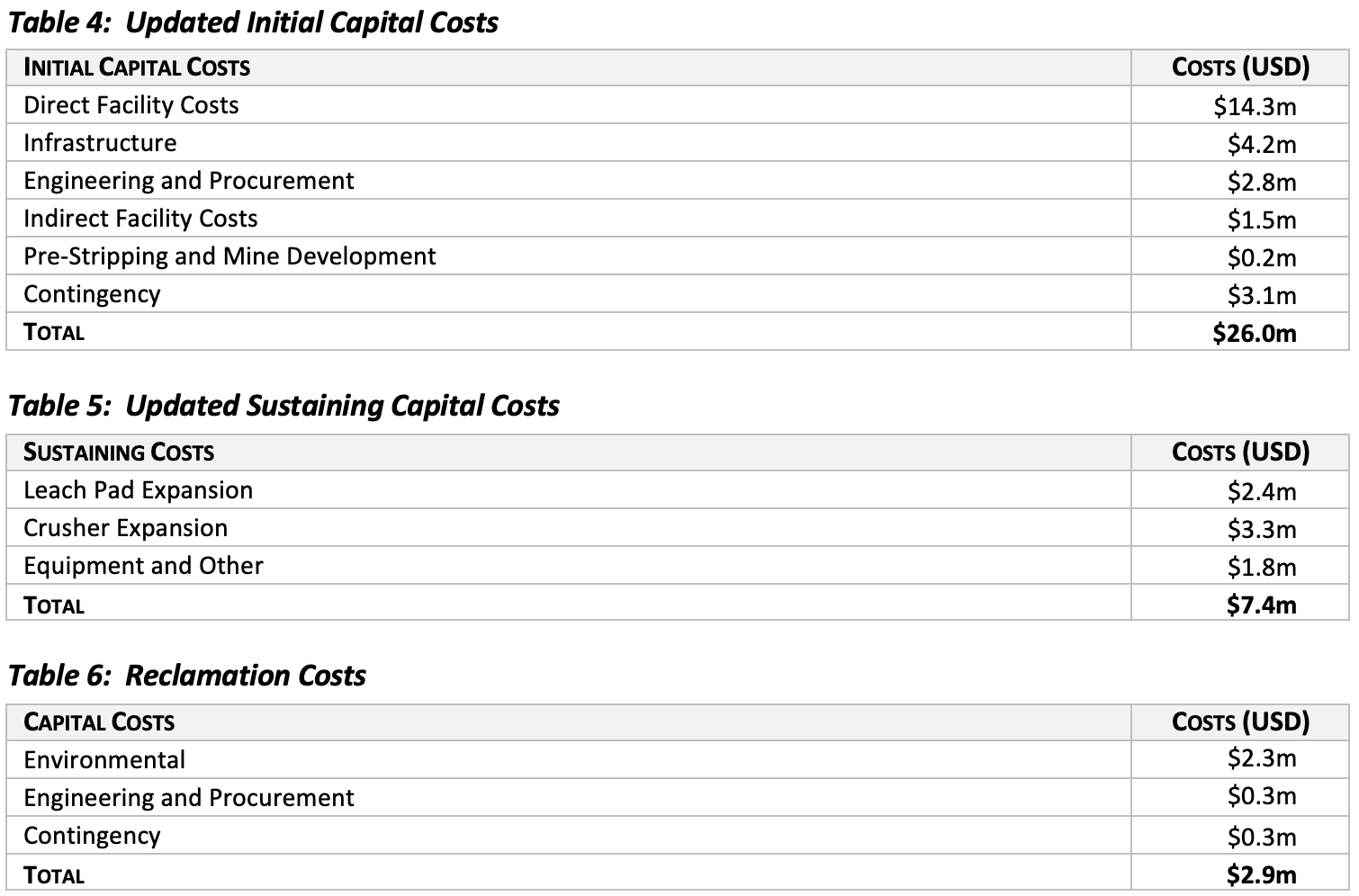

The updated estimated capital costs for the Cerro Caliche Gold Project are based on an open pit, heap leach operation with contract mining. Initial capital expenditures of USD $26 million, including 15% contingency, contemplates an initial two-year production rate of 8,000 mtpd with an increase to 15,000 mtpd in the third year of production.

Initial capital costs include direct facility costs such as crushing equipment, processing facilities and leach pad impoundment as well infrastructure, EPCM, site preparation and indirect facility costs such as technical studies, office equipment and light vehicles.

An additional USD $7.4 million is estimated for updated sustaining capital including the expansion of the crushing circuit and heap leach pad, as well as equipment and equipment replacement costs. Reclamation costs remain the same at an estimated USD $2.9 million.

Updated capital cost estimates are based on industry standards and were developed using quotes provided by mining contractors and specialists experienced in mining development in Mexico.

Operating Costs

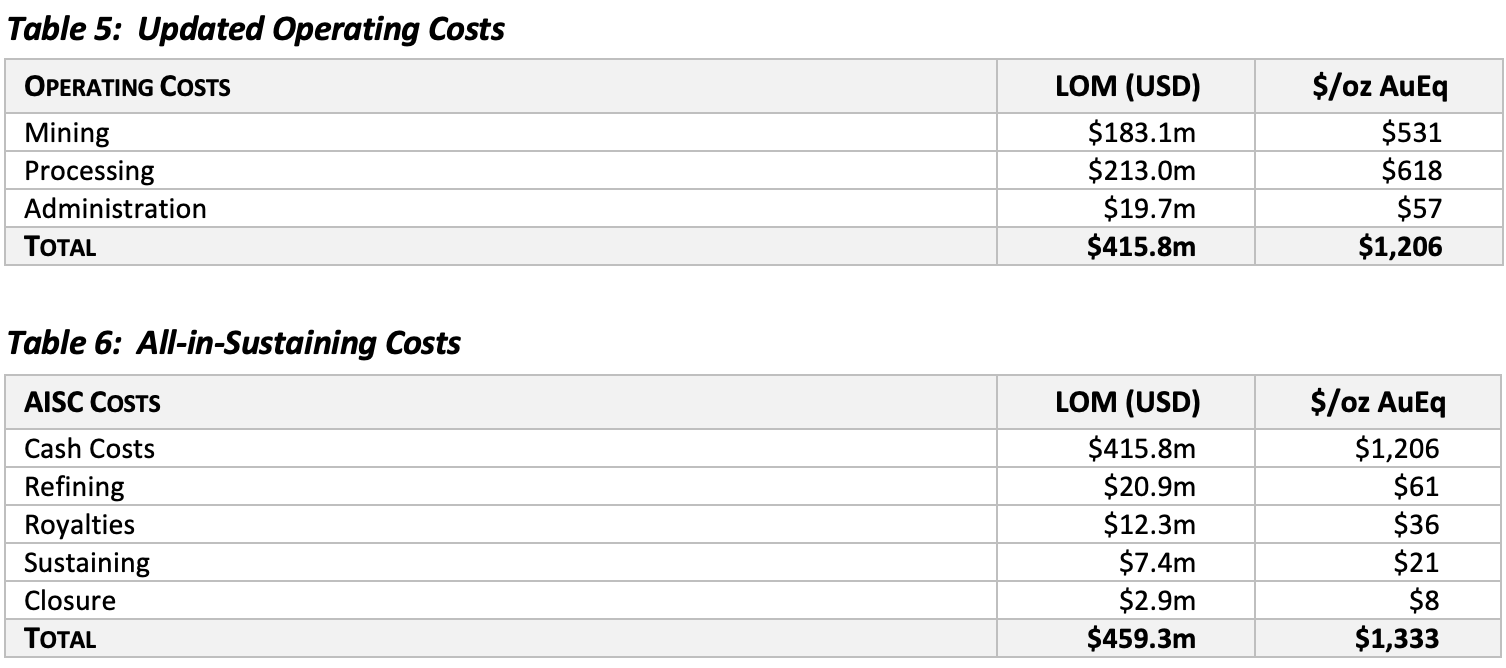

Updated cash costs for Cerro Caliche’s LOM are estimated at USD $415.8 million or USD $1,206 per gold equivalent ounce and include mining, crushing and processing, as well as maintenance and administration costs. Updated All-in Sustaining Costs for LOM are estimated at USD $459 million or US$1,333 per gold equivalent ounce and include operating costs, sustaining capital, reclamation, royalties and refining charges.

Royalties include a 2% NSR to certain landholders and taxes include payments to the Mexican government for mining royalty and specific mining related taxes. Refining costs include shipping loaded carbon to a 3rd party processing facility, as well as costs for processing the carbon and production of doré bars.

Open pit mining will be undertaken by a contractor and carried out by drill and blast conventional loading and truck haulage to the crushing facility. An estimated mining cost of USD $1.85 per tonne includes drilling, blasting, hauling waste and mineralized ore to the heap leach area.

The processing facilities at Cerro Caliche will be comprised of a crushing circuit where mineralized material is processed through a three-stage crushing plant to produce material that is p80 of ½” (80% passing) method. The material is then conveyed and stacked in a conventional heap leach pad and irrigated with a low concentrate cyanide solution. An estimated crushing cost of USD $0.82 includes the cost of crushing and conveying. Solution collected from the leach pad is then directed through a system of channels to the processing ponds where it passes through a series of carbon columns. Gold and silver impregnated carbon is collected periodically from the columns and then dried and shipped to a 3rd party processing facility for stripping and doré bar production. An estimated processing cost of USD $5.80 per tonne operating costs includes leaching, assaying, carbon handling and labour.

Operating cost estimates are based on industry standards and were developed using quotes provided by mining contractors and specialists experienced in mining development in Mexico.

Qualified Person Statement

David Salari, P.Eng. of D.E.N.M. Engineering Ltd., and William Lewis, P.Geo. of Micon International Limited, both of whom are independent of the Company, have reviewed and approved the scientific and technical information herein regarding the Company’s Cerro Caliche Project. William Lewis, P.Geo., was responsible for the updated Cerro Caliche Mineral Resource Estimate and, along with David Salari, P.Eng., has approved the information pertaining to the Cerro Caliche Project in this news release. Each of David Salari, P.Eng. and William Lewis, P.Geo., is a Qualified Person as defined in NI 43-101.

Stephen Kenwood, P.Geo., a Director of Sonoro Gold, is a Qualified Person within the context of NI 43-101 and has read and approved this news release.

About D.E.N.M. Engineering Limited

D.E.N.M. Engineering Ltd. is a niche engineering company servicing the mining / mineral processing sector that specializes in Engineering & Design, Equipment Supply, Project & Construction Management, Commissioning and Operations Support. D.E.N.M. Engineering Ltd. has proven success while championing projects for over fifteen years in Canada, USA, Mexico and Central America.

In addition, D.E.N.M. Engineering, with its principal and independent specialists, performs NI 43-101 compliant assessments and studies in the sections of mineral processing metallurgical design, process design, capital and operating costing and cash flow analysis.

About Micon International Limited

Micon International Limited (Micon) has provided consulting services to the worldwide mining industry since 1988 from its offices in Canada and the UK. Micon comprises a multi-disciplinary group of highly qualified and experienced professionals who are guided by the Company principles of Integrity, Competence and Independence.

Micon’s experience in Mexico ranges from exploration programs and resource estimation to technical studies on operating mines, as well as due diligence for precious metals and base metals projects. Micon has worked in most of the major mining districts throughout Mexico, as well as some lesser-known historical districts. In northern Mexico, assignments have been undertaken in the gold and silver districts of Sonora, Durango, Zacatecas, Chihuahua and Baja California.

About Sonoro Gold Corp.

Sonoro Gold Corp. is a publicly listed exploration and development Company holding the near-development-stage Cerro Caliche project and the exploration-stage San Marcial project in Sonora State, Mexico. The Company has highly experienced operational and management teams with proven track records for the discovery and development of natural resource deposits.

On behalf of the Board of SONORO GOLD CORP.

Per:

“Kenneth MacLeod”

Kenneth MacLeod

President & CEO

For further information, please contact:

Sonoro Gold Corp. – Tel: (604) 632-1764

Email: info@sonorogold.com

Forward-Looking Statement Cautions:

This press release may contain “forward-looking information” as defined in applicable Canadian securities legislation. All statements other than statements of historical fact, included in this release, including, without limitation, statements regarding the Cerro Caliche project, and future plans and objectives of the Company, including the NPV, IRR, initial and sustaining capital costs, operating costs, and LOM production of Cerro Caliche, constitute forward looking information that involve various risks and uncertainties. Forward-looking information is based on a number of factors and assumptions which have been used to develop such information but which may prove to be incorrect, including, but not limited to, assumptions in connection with the continuance of the Company and its subsidiaries as a going concern, general economic and market conditions, mineral prices, the accuracy of Mineral Resource Estimates. There can be no assurance that such information will prove to be accurate and actual results and future events could differ materially from those anticipated in such forward-looking information. Important factors that could cause actual results to differ materially from the Company’s expectations include exploration and development risks associated with the Company’s projects, the failure to establish estimated Mineral Resources or Mineral Reserves, volatility of commodity prices, variations of recovery rates, and global economic conditions. The forward-looking information contained in this release is made as of the date of this release. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law or the policies of the TSX Venture Exchange. Readers are encouraged to review the Company’s complete public disclosure record on SEDAR at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.