Dear Valued Shareholder,

On September 10, 2025, and October 22, 2025, Sonoro Gold (“Sonoro”) closed consecutive non-brokered, private placements for CAD $2M and CAD $4.1M respectively, raising total gross proceeds of over $6.1M. Proceeds have been primarily allocated for the ongoing development of our flagship Cerro Caliche gold project but a modest amount of funds have also been allocated for the proposed spin-out of the San Marcial gold-silver project.

Shareholders and insiders continue to exercise warrants, with over 34.3 million warrants exercised to date in 2025. Insiders now hold over 26% of all outstanding shares issued.

Value Added Tax (VAT) refunds received to date total approximately CAD $415,000, with a further CAD $2.1M in VAT refunds expected by Q1 of 2026.

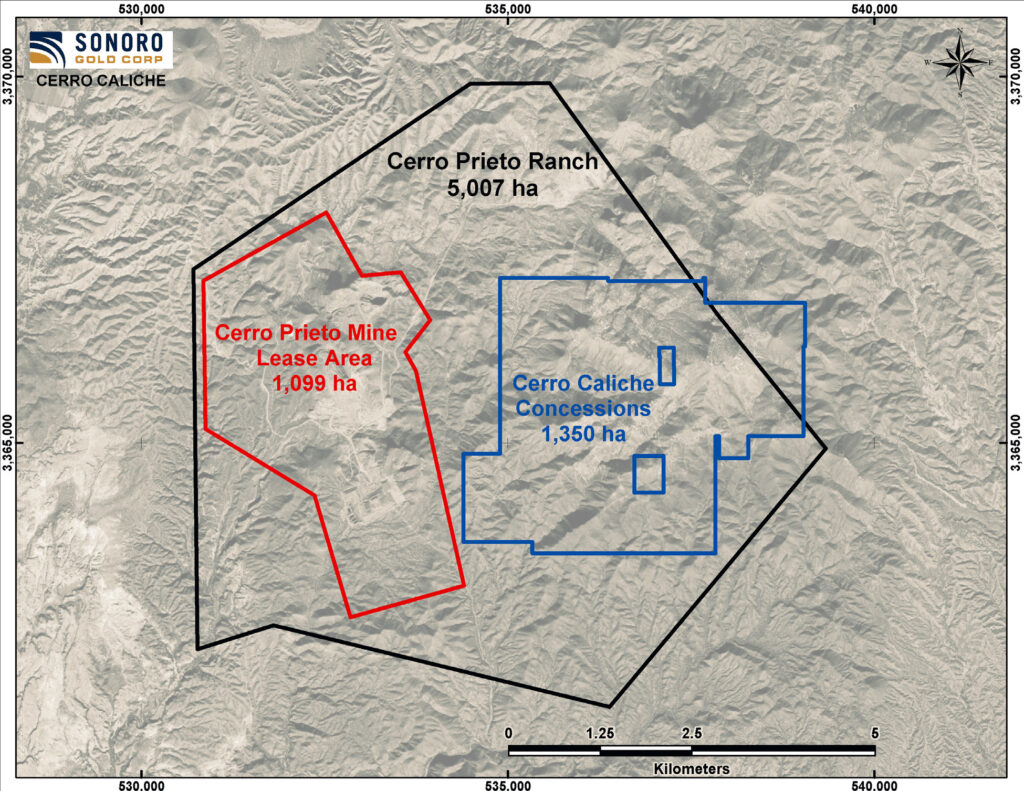

Mining Concessions and Surface Rights

On October 30, 2025, Sonoro announced that it had made the final concession payment of US $919,907.71 on the Cerro Caliche project, securing 100% ownership of the project’s mineral concession titles. Cerro Caliche is comprised of 15 contiguous mining concessions which Sonoro optioned in 2018 under five separate option agreements for total consideration of US $5.18M.

Financial obligations under the five option agreements have now been met and all concession titles have been registered to Sonoro’s wholly-owned Mexican subsidiary, Minera Mar de Plata (“MMP”).

On July 4, 2025, Sonoro announced that it had executed a surface rights agreement with the landowner of the Cerro Prieto Ranch to secure the exclusive surface rights to the Cerro Caliche property and surrounding areas.

Mineral rights and surface rights are separate, and in many jurisdictions like Canada and the US, mineral rights are the “dominant estate”. This means that the concession holder has the legal right to access and extract minerals from the land. This is not the case in Mexico. Under Mexican law, a mining concession does not include rights to the surface where the mining concession is located. Mining rights are controlled by government whereas surface rights are controlled by the landowner.

The Cerro Caliche surface agreement has a term of up to 25 years and grants MMP exclusive control over 3,908 hectares initially, ensuring sufficient land for the development of the project and related mining infrastructure. On September 1, 2028, surface rights under the agreement will expand to encompass the entire 5,007-hectare Cerro Prieto Ranch, including the surface rights to the neighbouring Cerro Prieto mine. To operate, all mining concession holders within the Cerro Prieto Ranch will need to obtain their respective surface rights directly from Sonoro.

Permits

Permits are issued by the Mexican permitting authority, Secretaria de Medio Ambiente y Recursos Naturales (“SEMARNAT”). The construction and operation of the proposed Cerro Caliche gold mine require two environmental permits:

- Environmental Impact Assessment (“Manifestacion de Impacto Ambiental” or “MIA”)

- Change of Land Use (“Autorizacion en Cambio de Uso de Suelo” or “CUS”)

Sonoro formally filed in May 2022, supported by multiple environmental baseline studies and extensive socio-economic assessments completed by our technical team and third-party consultants. Since the initial filing, Sonoro, in consultation with SEMARNAT, has made subsequent revisions to the MIA to ensure mine plan optimization and the highest possible social and environmental standards.

The CUS filing must include confirmation of surface rights and be supported by a Justification Study for the Change of Land Use, or Estudio Tecnico Justificativo (“ETJ”), detailing preventive and mitigative initiatives for the proposed Cerro Caliche project area. With the surface rights now secured for a mining operation, Sonoro can initiate the ETJ study and file the CUS submission by the end of 2025. A Change of Land Use authorization will be subject to a fee payable to SEMARNAT to cover the mitigation and restoration costs.

Updated PEA

In October 2025, Sonoro engaged P&E Mining Consultants Inc. (“P&E”) of Brampton, Ontario to complete an updated NI 43-101 compliant Preliminary Economic Assessment (“PEA”) on the Cerro Caliche project. P&E was established in 2004 and has extensive experience in geological interpretation, 3D geologic modeling, technical report writing, Mineral Resource and Mineral Reserve Estimates, property evaluations, mine design, production scheduling, operating and capital cost estimates and metallurgical engineering.

The current PEA was filed in October 2023 and used a base case price of US $1,800 per ounce of gold. The updated PEA will reflect an increased gold price as well as updated capital cost and operating cost estimates. The project’s production schedule and mine plan are also being revised, and a lower cut-off grade may also be implemented, potentially increasing the estimated mineral resource (“MRE”). Results of the updated MRE will be announced concurrently with the economic results of the PEA.

The MRE will be based on a total of 55,360 meters of drilled data, including 498 drill holes and 17 trenches, representing approximately 30% of the project’s identified mineralized zones. Management’s objective is to develop an initial open pit, heap-leach gold mining operation to fund ongoing exploration to potentially expand the resource and extend the life of mine.

The updated PEA is expected to be completed in Q1 of 2026.

San Marcial

Sonoro also holds 100% title to the concessions for its wholly owned San Marcial gold-silver project, also located in Sonora, Mexico. Management is currently evaluating the shareholder benefit of a strategic reorganization of Sonoro’s assets, whereby it would spin out its San Marcial gold-silver project into its wholly owned subsidiary Oronos Gold Corp. (“Oronos”). A spin out maybe an effective strategy to unlock the currently unrecognized value of San Marcial and fund development without diluting shareholders’ holdings in Sonoro.

The reorganization would need to be done pursuant to the arrangement provisions of the BC Business Corporations Act and would require approval by both the BC Supreme Court and at least 66 2/3% of Sonoro Shareholders voted at a special general meeting. A required Information Circular for the meeting must include a prospectus-level disclosure on Oronos, as well as a current independent NI 43-101 technical report on the San Marcial project.

To apply for a listing of Oronos shares on the TSX Venture Exchange, Oronos will need to demonstrate at least CAD $100,000 in exploration expenses at San Marcial within 36-months prior to the listing application. It will also need to have at least $200,000 for an exploration program, as recommended by the technical report, as well as another $100,000 in unallocated funds for working capital.

To satisfy the listing requirements of the TSX Venture Exchange, Oronos may contemplate a private placement as a part of the reorganization.

Understandably the spinning out of an asset can be a timely and costly process and Sonoro will not formally announce any reorganization plans until the Board has reviewed an independent valuation of the San Marcial project.

Sonoro’s technical team undertook an extensive soil sampling program at San Marcial after the project was first acquired in 2014, revealing anomalous zones with multiple structural trends with gold and silver mineralization. The project overlays the historic Soledad and San Marcial mine sites and Sonoro believes the project has the potential for large low-grade gold-silver mineralization.

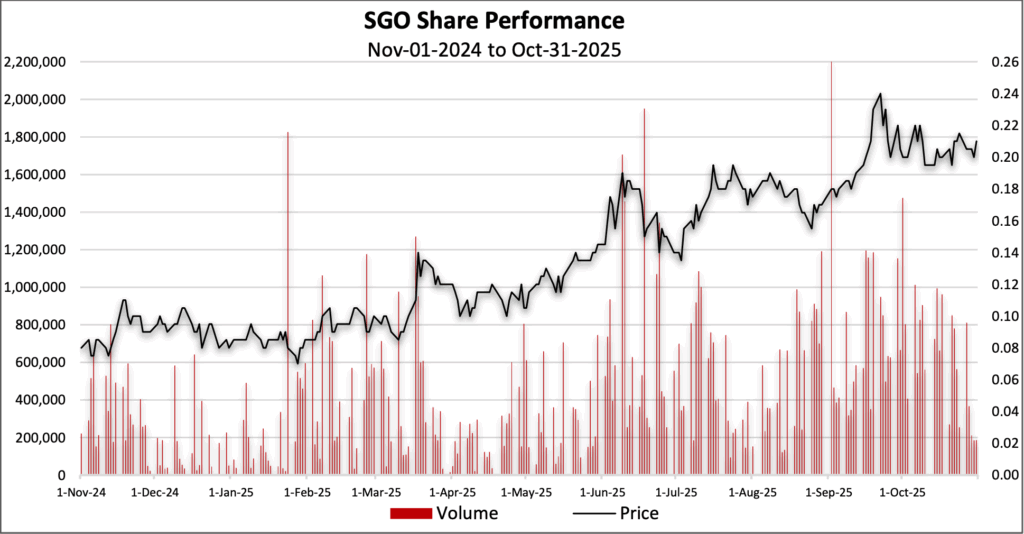

Sonoro Share Performance

Sonoro’s shares continue to experience strong growth and excellent liquidity in the Canadian, US and German stock markets. The chart below illustrates Sonoro’s share performance and trading volumes on the Canadian markets for the past 12-months, a performance which is reflected in the US and German markets.

CFO Change

On October 30, 2025, Sonoro announced that Chief Financial Officer (“CFO”), Salil Dhaumya, resigned from his position with Sonoro to pursue other endeavors. Mr. Dhaumya joined Sonoro in December 2019 and was a valued member of our management team. On behalf of the Board, I want to thank Mr. Dhaumya for his commitment and dedication during his time at Sonoro. Board member and Corporate Secretary, Katharine Regan will assume the role of interim CFO until a suitable successor is appointed. Ms. Regan has worked closely with Mr. Dhaumya over the years, and we appreciate Mr. Dhaumya’s ongoing assistance with the transition.

As always, please contact me directly at john@sonorgold.com with any questions or comments on Sonoro or our mineral projects.

I also encourage you to join our online communities on X, Facebook, LinkedIn, Instagram and YouTube, and visit Sonoro’s website to view and/or sign-up for the latest news and presentations.

Kindest Regards,

John M. Darch, Chairman

Sonoro Gold Corp.

Forward-Looking Statement Cautions:

This press release may contain “forward-looking information” as defined in applicable Canadian securities legislation. All statements other than statements of historical fact, included in this release, including, without limitation, statements regarding the Cerro Caliche project, and future plans and objectives of the Company, constitute forward looking information that involve various risks and uncertainties, including statements regarding completion of an updated preliminary economic assessment of the Cerro Caliche Gold project, the possible outcomes of an ongoing strategic asset review, the possibility of a transaction to spin out the Company’s San Marcial gold-silver project, an application for a public listing of the shares of Oronos Gold Corp., and plans for further exploration of the San Marcial project. Although the Company believes that such statements are reasonable based on current circumstances, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are statements that are not historical facts; they are generally, but not always, identified by the words “expects”, “plans”, “anticipates”, “believes”, “intends”, “estimates”, “projects”, “aims”, “potential”, “goal”, “objective”, “prospective” and similar expressions, or that events or conditions “will”, “would”, “may”, “can”, “could” or “should” occur, or are those statements, which, by their nature, refer to future events. The Company cautions that forward-looking statements are based on the beliefs, estimates and opinions of the Company’s management on the date the statements are made and they involve a number of risks and uncertainties, including the possibility of unfavorable exploration and test results, the lack of sufficient future financing to carry out exploration and development plans and unanticipated changes in the legal, regulatory and permitting requirements for the Company’s exploration programs. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law or the policies of the TSX Venture Exchange. Readers are encouraged to review the Company’s complete public disclosure record on SEDAR at www.sedar.com.

This press release does not constitute or form a part of any offer or solicitation to purchase or subscribe for securities in the United States. The securities referred to herein have not been and will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), or with any securities regulatory authority of any state or other jurisdiction in the United States, and may not be offered or sold, directly or indirectly, within the United States or to, or for the account or benefit of, U.S. persons, as such term is defined in Regulation S under the Securities Act (“Regulation S”), except pursuant to an exemption from or in a transaction not subject to the registration requirements of the Securities Act”

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.